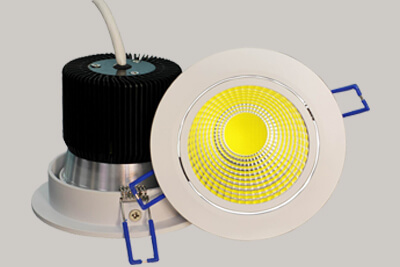

The launch of Chip on Board (COB) is a relatively new technology of LED packaging for LED light engine. Multi LED chips are packaged together as one lighting module. When it lights up, it looks like a bright lighting panel. Well-known brands such as Bridgelux & Citizen were very aggressive in promoting this technology when LED as a product segment was in its nascent stage, but slow penetration due to very high costs was discouraging. However, now with China producing COBs, the scenario is fast changing.

Lightspot China holds the patent (patent No20051003432.2) for the invention for COB LEDs & lamps in China. Although Lightspot is the only legal manufacture of COBs in China, the acquired patent is not a recognised as an international patent. The rest of the manufacturers in China are technically illegal manufacturers.

Compared with traditional lighting such as Quartz halogen lamps, COB is a perfect match for super bright, small size lamp sources but on the downside might cause uncomfortable glare. It is in this light that it is recommended for COBs products to include diffused optical lens. Such COBs usually cause less glare and the effect of zebra strips is nullified. However, if the light beam passes through an optical lens, it will cause slight light loss.

Towards the end of 2015, some famous LED chip manufacturers in Malaysia have almost reached 249lm/watt @ 20mA. However, large size LED chips can only reach 161lm/watt @350mA; the light efficacy decreases when the chip size is bigger. Additionally, when an LED driver increases current in an LED, the light efficacy per watt is even low. In the near future, COBs with small chips will be a trend in LED light source package and product.

Market Scenario

The world over, attempts are being made to save on energy consumption without diluting or compromising on the quality of energy consumed. Lighting in industrially-developed countries consumes between 5-15% of the electrical load, while in India ELCOMA figures suggest the energy consumption of almost 19% on lighting alone. COB LED technology has emerged due to its features such as low power consumption, cost-effective lighting, and high intensity output. COB LED market contributes around 7 to 8% to the overall market for LED and can be expected to reach around 20% in the near future.

The market for COB LED is still at the growing stage and has high potential to grow in future. The government’s support towards banning incandescent lighting and urbanization will lead to an increase in the demand for COB LED lights. At present, pricing is the main hurdle for COB LED technology but that will also be soon resolved; as companies will achieve technology expertise and economies of scale; thereby making it more competitive with respect to conventional lighting. COB LED will be mainly preferred for illumination due to its high density and better color mixing.

In the global market, APAC is the market leader in COB LED technology; both in terms of manufacturing companies and usage. China, Japan and Taiwan are the main contributors to the overall market. They are followed by the U.S.; where urbanization and government’s support are driving forward the lighting market. Europe is close behind the U.S., where lighting is taking a toll due to an increase in the usage of ultra modern lighting in the hospitality industry and architectural lighting. The rest of the world caters to the Middle East and Africa; where Dubai is the largest contributor to infrastructure and lighting.

The global market is expected to reach $3.4 billion in 2016 at a CAGR of 38.5% from 2011 to 2016. The application market will be more inclined towards illumination in general lighting and is expected to reach to $2.9 billion in 2016 at a CAGR of 36.9% from 2011 to 2016.

Application Market

To understand the COB LED market further, its segmentation needs to be understood. COBs are segmented into four major applications viz. illumination, automotive, backlighting and others. “Others” applications is further segmented into medical equipment and projectors. Here, illumination is further divided into various sub applications such as residential, commercial, architectural, hospitality, outdoor, and industrial. Automotive is further divided into interior automotive application and exterior automotive application; wherein exterior applications consist of headlamps, side lamps, rear lamps, and DRLs. Backlighting is further divided into LED television, handhelds, monitors, and screen display lighting.

COBs & Array Construction Details

LED arrays can be built using several methods. Each method hinges on the manner in which the chips themselves are packaged by the LED semiconductor manufacturer. Examples of packaged, lensed LEDs (previous generation popularly called as Button LEDs) are shown in Figures 1, 2 and 3. Importantly, it is also possible to procure wafers of bare, unpackaged chips, also called “dice”.

Using automated pick-and-place equipment, ProPhotonix takes such individual chips and affixes them to printed circuit boards, creating so-called “chip-on-board” LED arrays. Close-up microscopic photographs of chip-on-board arrays are shown in Figure 5.

An LED array is generally built up on a printed circuit board. The pins or pads or actual surfaces of the LED chips are attached to conductive tracks on the PCB. PCB materials may include fiberglass-filled epoxy, ceramics or metals, depending on thermal and mechanical requirements.

In cases in which t-packs cannot provide the required performance, chip-on-board emerges as the answer. The obvious advantages of chip-on-board LED arrays are:

Compactness

A notable advantage of chip-on-board LED arrays is that these are amenable to superior heat sinking during continuous, moderate-power operation. It ensures efficient design to ensure that LED PN junction temperatures are as low as possible, which leads to long lifetime as well as wavelength and intensity stability.

While the heat from a t-pack LED can only be directed away from the PN junction via the electrodes, the situation is much better when, as in the case of chip-on-board, the chips are placed in intimate contact with a properly designed, thermally efficient substrate structure. See Figure 6. The red arrows indicate the flow of heat.

A new competency of ProPhotonix’ LED division revolves around its state-of-the art automated pick-and-place and wire bonding equipment. These capabilities, combined with the company’s close relationships with various PCB manufacturers and semiconductor houses, enable ProPhotonix to undertake a program of research on LED chip-on-board methods. ProPhotonix has recently developed a new proprietary LED array method, dubbed chip-on-board reflective array (COBRA™). This patent pending technology combines the thermal advantages of chip-on-board with the optical efficiency of a reflective cup.

The advantages of recent COBRA designs are illustrated in Figure 8. In applications requiring particularly high brightness and directional illumination, ProPhotonix implements the COBRA approach for the construction of the LED array.

The light emitted from these devices has been set in accordance with IEC60825. However, staring into the beam, whether directly or indirectly must be avoided. IEC60825 classifies laser products into three categories depending on light emitted, wavelength and eye safety. While on laser COBs, visible laser light less than 1.0mW (Class II) are considered eye safe, normal exposure to this type of beam will not cause permanent damage to the retina.

Class IIIR – “Danger”, visible laser light between 1.0mW and 5.0mW. Considered eye safe with caution. Focusing of this light into the eye could cause some damage.

Class IIIB – “Danger”, infrared (IIIR), and high power visible laser considered dangerous to the retina if exposed.

In short laser COBs/LEDs must be handled with caution.

There are some more cautions to heed when selecting COBs from any manufacturer. Regretfully in LED, manufacturers do not provide any branding on the LED packaging in general and identifying the genuineness of the make of the LEDs/COBs is indeed a matter of faith in the product brand. This has been misused by many lighting product handles by claiming branded COBs/LEDs while actually using spurious or inferior chips under the disguise of branded chips. The only guaranteed way to identify the genuineness of the make is to test its foot prints with the company’s declared foot print which requires an isolated COB to check the PAD sizes. Even the local representatives of the branded COB product manufacturers have expressed their inability to certify their products in India. They insist in sending it to their manufacturing units for certification which is again a long drawn process.

To save on manufacturing costs, cheap & inferior COB manufacturers are using critical bonding wire (Gold Line shown in fig. 8) made of aluminium rather than gold wire even going to the extent of using normal ferrous wires. The heat sink wafer used could also be an aluminium look alike magnesium or commercial grade (recycled aluminium) base for wafer moulding which affects heat dissipation while in continuous use of COBs. This will further deteriorate the life time of such COBs and the product failures arising out of such mediocre manufacturing at the sacrifice of quality & longevity.

Readers are advised to refrain from using such low grade Chinese COBs in critical constructions such as Hospitals, Banks, Offices and manufacturing Premises.

New developments from onslaught of COBs now is development of MCOBs. In this design platform multiple COBs are placed and integrated together to form a larger COB as an effective (Ref Fig 9) light source.

These developments once ready and tested will be ideal in large industrial installations such as High Bays / Sports stadium Lighting and Railway Signalling and Head Light applications in time to come. A lager cluster will bring in higher wattages in more compact sizes, thus increasing the heat dissipation issues, but science has now learnt to take care of heat in a more effective way by using better thermal materials for transfer of heat to heat sink efficiently. The biggest advantages will be the compact sizes of emerging bright yet tiny light source will reduce the luminaire size and will further bring down wind Surface areas of these luminaires, resulting into better economy in associated installation aesthetics and materials.

Market

The global market is expected to reach $3.4 billion in 2016 at a CAGR of 38.5% from 2011 to 2016. The application market will be more inclined towards COB illumination in general lighting and is expected to reach to

| $2.9 billion in 2016 at a CAGR of 36.9% from 2011 | 21 |

| to 2016. A Market expansion is graphically | |

| established as shown in the Fig 9. |

COB LED disadvantages:

COB packaging technology bottleneck is how to improve the reliability of the light source, and its operating temperature.

However, most of the current market COB packaging companies are small and they mostly use aluminium substrate as the material. Aluminium COB reliability is low because of its greater thermal resistance, easy to cause death LED or high light attenuation. The ceramic substrate is an ideal COB material, but its cost is relatively high, especially for power less than 2W, which will be unaccepted by a customer.

Also, the demand of COB light source on the market is still low in India due to frequent failures of low priced imports by importers. In addition, COB LEDs still suffer standardization issues. BIS & ELCOMA have to initiate the standards of package manufacturers although ZHAGA Consortium in Europe is making a serious attempt to standardise the technology.

Application

Currently, the main applications for COB LED are mining lamps, spot lights, street lights and so on.