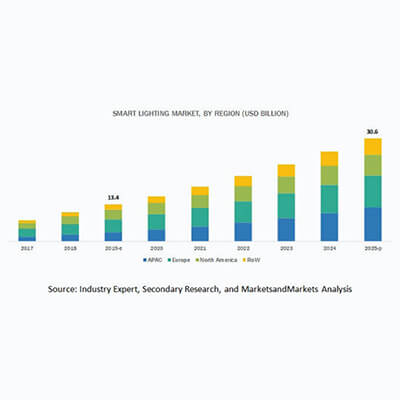

The smart lighting market is estimated to grow from USD 13.4 billion in 2020 and projected to reach USD 30.6 billion by 2025, at a CAGR of 18.0%.

In a recent study on the world’s lighting industry estimates the size of global smart lighting market to reach USD 30.6 billion by 2025 from USD 13.4 billion in 2020, registering a CAGR of 18.0%. In fact, ResearchAndMarkets.com has come with a fresh report predicting the growth trajectory of global smart lighting. Named as “Smart Lighting Market by Offering (Hardware: Lights & Luminaires, Lighting Controls; Software, and Services), Communication Technology (Wired and Wireless), Installation Type, End-use Application, and Geography – Global Forecast to 2025”, the report entails the factors of its claims in detail.

Policies Matter

Government initiatives and policies for energy savings are bound to drive the growth of smart lighting market. The major factors driving the growth of the smart lighting market include the advent of integrated lighting control systems, upcoming smart city projects in developing economies, increasing adoption and decreasing cost of LEDs, integration of lighting solutions with smart devices, and growing awareness about energy savings among consumers and governments worldwide. Factors such as the high installation cost of smart lighting systems and security and reliability issues with IoT-based lighting systems are restraining the growth of the smart lighting market.

Lights & Luminaires to Account for Larger Share

Meanwhile, the smart lighting hardware market for lights & luminaires is expected to hold the major share during the forecast period, mainly due to the advent of integrated lighting controls with lamps and luminaires. The integration of lighting control products with luminaires enables the embedding of software on microcontrollers, thereby adding intelligence to the entire lighting control system. Such lighting systems offer sensing and control at a spatial resolution, which would drive the demand for smart lights and luminaires during the forecast period.

Role of Wired Technology

Wired technology is expected to hold a larger share of the smart lighting market by 2025. Currently, the smart lightings based on wired technology are widely adopted for different types of structures as this technology offers reliable connectivity, with no limitation on long-distance data transfer. Wired communication technologies for smart lightings include Digital Addressable Lighting Interface (DALI), Power-line Communication (PLC), Power over Ethernet (PoE), and various wired hybrid protocols, which include company-specific proprietary protocols. Wired protocols offer reliable performance and greater control; thus, the technology held the largest share of the market.

PoE Protocol to Exhibit Highest Growth

The Power over Ethernet (PoE) wired communication technology market is expected to grow at the highest CAGR, during the forecast period. The growth of the PoE protocol segment is driven by factors such as increasing penetration and decreasing cost of LEDs, growing adoption of PoE lighting solutions in commercial and healthcare applications, and rising need for cost-effective lighting solutions.

Contribution from Highways & Roadways Lighting Application Segment

Going forward, the highways & roadways lighting application segment holds the largest market share of the outdoor smart lighting application due to government support and subsidies encouraging the installation and use of smart lighting control solutions during the forecast period. As of now, the latest trend in the street lighting segment is the replacement of existing street lighting sources with LED street lights to reduce energy consumption significantly.

Smart Lighting Market in APAC

The smart lighting market in APAC is expected to grow at the highest CAGR during the forecast period. This growth is attributed to rapid infrastructure building activities being undertaken in APAC, mainly in China and India, where smart lighting paves the way for the modernization of infrastructure. The modernization and development of infrastructure such as smart cities across the region, coupled with government policies to support energy-efficient lighting, would also drive the demand for smart street lights, thereby driving the market for smart lighting in this region.

The agency claims that in the process of determining and verifying the market size for several segments and sub-segments gathered through secondary research, extensive primary interviews have been conducted with the key experts.

Key Market Players

Some of the major players in the smart lighting market, as the study indicates, are Signify (Philips Lighting, Netherlands), Legrand SA (France), Acuity Brands, Inc. (US), Eaton Corporation (Ireland), General Electric Company (US), and OSRAM Licht (Germany), Lutron Electronics (US), Zumtobel Group (Austria), Honeywell International Inc. (US), Hubbell Incorporated (US), and Leviton Manufacturing Company, Inc. (US). Other players operating in the smart lighting market include Dialight PLC (UK), Helvar (Finland), Ideal Industries, Inc. (Cree Lighting) (US), Adesto Technologies (Echelon Corporation) (US), Panasonic (Japan), LightwaveRF PLC (UK), RAB Lighting (US), Synapse Wireless (US), Syska LED (India), Wipro Enterprise Ltd (India), LG Electronics (South Korea), ABB (Switzerland), and Enlighted Inc (a Siemens company) (US).

Signify – The Leader

Signify Holding (Netherlands) is an industry leader in the lighting market space. The company’s market experience and brand name allow it to capitalize on the fundamental market dynamics in the lighting industry and deliver innovative solutions that create value and ensure its growth. The company has a huge advantage over its competitors in the smart lighting market due to is its extensive product portfolio, with lighting systems compatible with various connecting technologies ranging from DALI, KNX, and BACnet to ZigBee and EnOcean.

The company aims to further invest in connected lighting systems to win contracts related to the supply of connected lighting systems and other lighting control equipment. It also adopts the strategy of acquisitions. For instance, in October 2019, Signify acquired Cooper Lighting Solutions from Eaton. This acquisition would strengthen its position in the North American lighting market. Also, in April 2019, it acquired WiZ Connected—a developer of the WiZ Wi-Fi-based connected lighting ecosystem. This acquisition will allow Signify to extend its leadership position in the Wi-Fi-based smart lighting market.